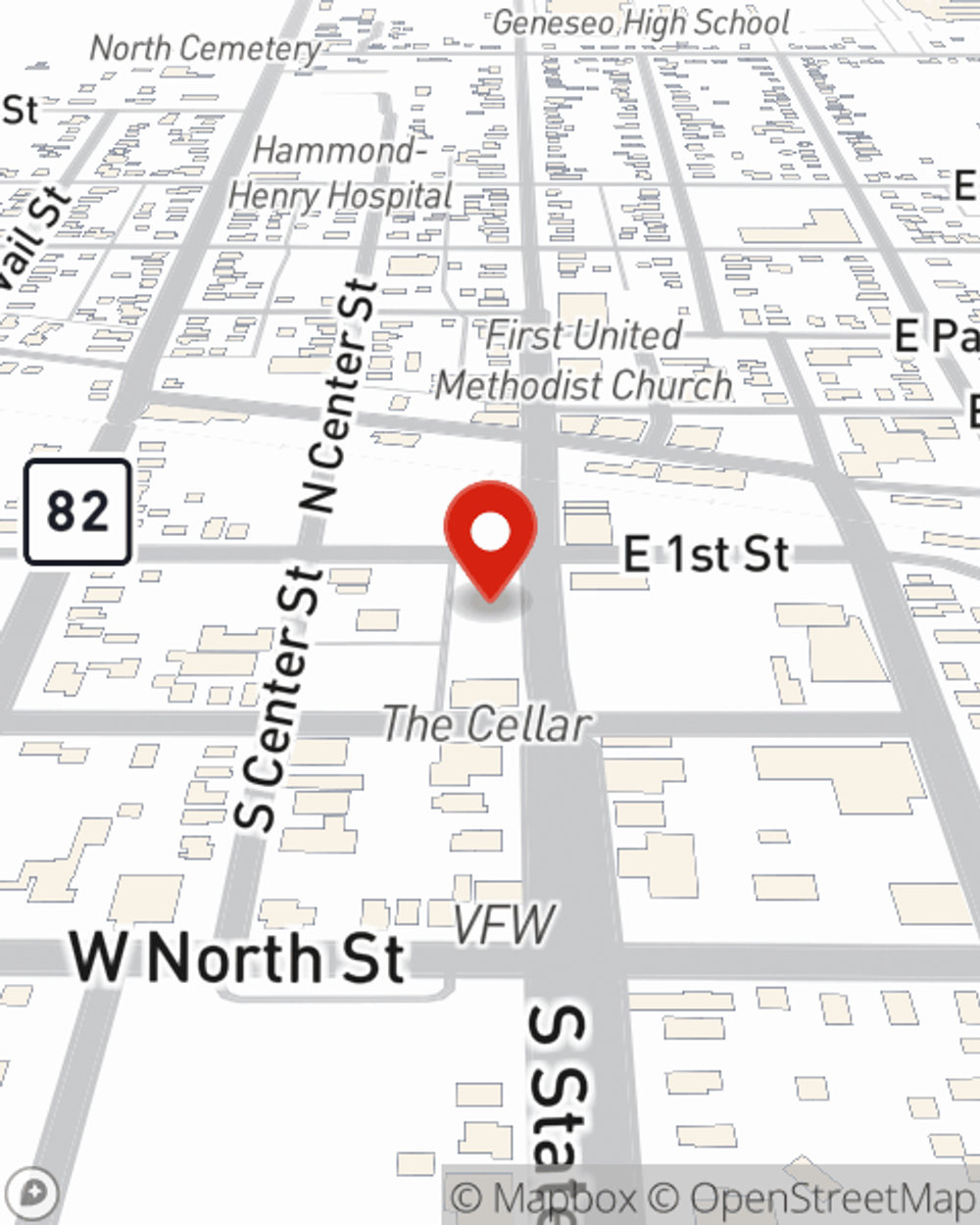

Auto Insurance in and around Geneseo

Auto owners of Geneseo, State Farm has you covered

All roads lead to State Farm

Would you like to create a personalized auto quote?

- Geneseo

- Cambridge

- Orion

- Coal Valley

- Erie

- Atkinson

- Annawan

- Moline

- East Moline

- Davenport

- Bettendorf

Here When The Unexpected Arrives

Choosing your auto insurance provider doesn't have to be overwhelming. With State Farm, you can be sure to receive reliable coverage. Among the many different options out there for savings options and coverage options, State Farm makes the decision easy.

Auto owners of Geneseo, State Farm has you covered

All roads lead to State Farm

Great Coverage For A Variety Of Vehicles

But not only is the coverage great with State Farm, there are also multiple options to save. This can range from safe driver savings like the good driver discount to safe vehicle discounts like an anti-theft discount. You could even be eligible for more than one of these options! State Farm agent Bethany Winkleman would love to verify which you may be eligible for and help you create a unique policy that's right for you.

Plus, your coverage can be aligned with your lifestyle, to include things like rideshare insurance and car rental insurance. And you can cover a variety of vehicles—whether it's a car, RV, commercial auto or antique car.

Have More Questions About Auto Insurance?

Call Bethany at (309) 944-5123 or visit our FAQ page.

Simple Insights®

Drive safely with pets in cars

Drive safely with pets in cars

Learn how to drive safely with your pet or dog. No matter where you're headed, it's important to think about everyone who'll be traveling with you, especially children and pets.

Social media safety tips to protect your information

Social media safety tips to protect your information

With the popularity of social media continually growing, it's important to proactively keep yourself safe and your account information private information and secure.

Bethany Winkleman

State Farm® Insurance AgentSimple Insights®

Drive safely with pets in cars

Drive safely with pets in cars

Learn how to drive safely with your pet or dog. No matter where you're headed, it's important to think about everyone who'll be traveling with you, especially children and pets.

Social media safety tips to protect your information

Social media safety tips to protect your information

With the popularity of social media continually growing, it's important to proactively keep yourself safe and your account information private information and secure.